Europe is currently experiencing a solar boom driven by aggressive climate goals and the urgent need for energy security. While the technology is universal, the financial landscape is highly localized.

What Drives Solar Adoption?

The EU’s push for carbon neutrality by 2050 and the "REPowerEU" plan drive national legislation. Governments incentivize homeowners to generate their own power to reduce strain on national grids. Simultaneously, technological breakthroughs have reduced installation costs by nearly 90% over the last decade.

How Are Subsidies Designed?

Government support structures dictate your financial strategy through three main mechanisms.

- Upfront Grants: Provide immediate relief on capital expenditure (e.g., Hungary's generous subsidy programs).

- Tax Incentives: Offer rebates or VAT reductions to lower entry costs (e.g., Sweden's 'Grön Teknik').

- Feed-in Tariffs: Offer long-term passive income but often require higher initial investment.

Common Subsidy Types

Different countries employ different mechanisms to support solar adoption. Identifying which type applies to your region helps you select the right equipment.

Feed-in Tariffs (FiTs)

FiTs guarantee a fixed payment for every kilowatt-hour (kWh) of energy exported to the grid. This model favors systems designed to maximize total generation rather than just matching household consumption. France continues to utilize mandates and FiTs effectively, though rates across Europe have generally decreased.

Net-Metering

Net-metering credits homeowners for the excess electricity they send to the grid.

- 1:1 Offset: You get full credit for exports, making the grid a free battery.

- Time-of-Use: Credits vary based on when you export, encouraging generation during peak demand.

- Action: If 1:1 net-metering exists, plan your system sizing around potential future phase-outs to avoid oversizing losses later.

Upfront Grants & VAT Reductions

Direct financial injections are the most straightforward form of solar panel subsidies.

- VAT Cuts: Germany and the Netherlands have slashed VAT to 0% on solar components.

- Rebates: Sweden offers a simple 20% rebate on green technology.

- Impact: These measures immediately lower capital barriers and improve Return on Investment (ROI).

Low-Interest Loans Available

Governments frequently partner with banks to offer "green loans" with below-market interest rates. Hungary and local German programs offer direct grants and loans to stimulate adoption. These loans are preferable when the monthly payment is lower than your expected monthly energy savings.

Country-Specific Solar Subsidies

Regulations vary wildly across borders. Here is a technical breakdown of key European markets.

Germany

- Features: Germany leads with a 0% VAT rate on the supply and installation of PV systems (effective Jan 2023).

- Advice: German homeowners should pair PV arrays with battery storage. The instant VAT discount is superior to future disbursements, simplifying the financial calculation.

Netherlands

- Features: The Netherlands boasts high watts per capita and 0% VAT on PV systems for family homes. The 'salderingsregeling' (net metering) scheme has driven massive adoption but faces political pressure for a phase-out on January 1, 2027.

- Advice: Dutch residents should act before net-metering rules change. Size the system to cover current consumption, but prepare for a future where self-consumption becomes king.

Spain

- Features: Spain offers IRPF tax deductions for energy efficiency: 20% deduction for a 7% reduction in energy demand, and up to 60% for building-wide reductions.

- Challenges: Accessing these funds requires "before and after" energy certificates. The process is known for extensive paperwork and delays in payouts.

- Advice: Ensure all technical certificates are correct to avoid bureaucratic delays.

Italy

- Features: Italy boasts high solar potential and historically generous "Superbonus" schemes. However, strict local regulations, especially in historic areas, create certification burdens.

- Advice: Use experienced local installers who understand regional permitting. Factor "soft costs" (permitting and admin time) into your ROI calculation.

Poland & Central Europe

- Features: Rapid uptake is driven by aggressive incentives like the "Mój Prąd" (My Electricity) program. Rural regions in Central-Eastern Europe hold significant untapped potential for economic revitalization through solar.

- Advice: Verify installer warranties and panel quality. In a booming market, quality control can sometimes slip.

Ireland

- Features: Ireland has set ambitious national targets for 2030. The SEAI offers grants, but they strictly require the use of registered installers and specific hardware standards.

- Advice: Check installer eligibility before signing any contract. Prioritize home insulation first to maximize the value of the generated electricity.

Portugal

- Features: Portugal previously reduced its VAT on solar purchases to 6% (down from 23%); however, that reduced rate expired on June 30, 2025. The standard 23% VAT now applies to installations.

- Advice: Evaluate the long-term return on investment carefully, as the initial cost of solar installations is now higher due to the increased standard tax burden. The focus shifts entirely to the energy savings generated over the system's lifespan.

Summary Table: European Solar Incentives

|

Country |

Primary Incentive |

VAT Status |

Permit Difficulty |

Recommended Focus |

|

Germany |

0% VAT |

0% |

Moderate |

High Self-Consumption |

|

Netherlands |

Net-Metering (Risk of change) |

0% |

Low |

Maximize Export (for now) |

|

Spain |

IRPF Tax Deductions |

Reduced |

High |

Self-Consumption |

|

Portugal |

Energy Bill Savings |

23% (Standard) |

Moderate |

Efficiency First |

|

Sweden |

Green Tech Rebate |

Standard |

Low |

Simple Rebate Claim |

|

Italy |

Tax Credits (Superbonus) |

Reduced |

Very High |

Self-Consumption |

|

Poland |

Cash Grants (Mój Prąd) |

Standard |

Moderate |

Self-Consumption |

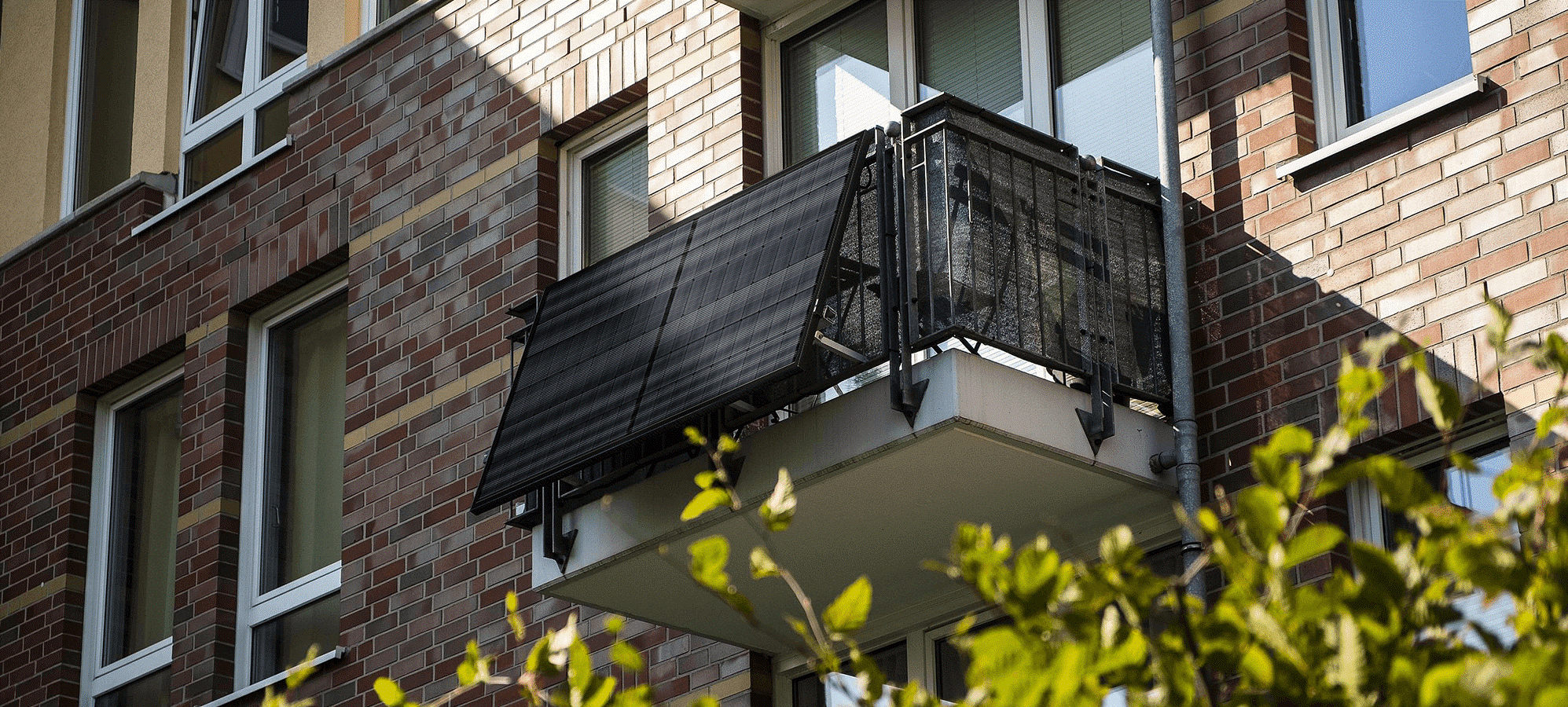

The Non-Subsidy Route: Portable Power Solutions

Not everyone can access the subsidies mentioned above. Renters, apartment dwellers, and those living in protected heritage zones often cannot secure the necessary permits to qualify for grants or VAT cuts. In these scenarios, the financial strategy shifts from seeking government aid to eliminating installation costs entirely. Portable solar generators offer energy resilience and bill reduction without the bureaucratic hurdles.

Note: Portable units typically do not qualify for government home improvement grants or feed-in tariffs, as they are not permanent grid-tied fixtures.

Recommended Solutions for Renters

If you are locked out of traditional solar ownership, portable options provide a viable alternative:

For Flexible Home Office Use: The Jackery Solar Generator 1000 v2 offers a balance of portability and power (1500W). It is best suited for keeping laptops, routers, and small appliances running during the day to offset peak-hour grid costs, with zero setup time.

For Heavy Duty Backup: The Jackery Solar Generator 2000 v2 pushes output to 2200W. This higher capacity is necessary if you intend to back up larger kitchen appliances or power tools. While the upfront cost is entirely out-of-pocket, the return on investment comes from immediate use without the "soft costs" of permitting and labor.

These units serve as flexible alternatives where rooftop solar is not feasible or permitted. To understand how storage fits into a broader energy plan, read about solar energy household battery backup solutions.

Decision Checklist

Follow this step-by-step process to navigate the application for solar panel subsidies.

- Regulatory Check: Determine if your property allows permanent modifications. If you are renting or in a heritage zone, skip to the "Portable Power" strategy. If you own the roof, confirm local net-metering rules and installer requirements.

- Calculation: Estimate your kWh/kWp production potential and realistic self-consumption rates based on your lifestyle.

- Preparation: Gather past electricity bills, roof dimensions, and building association rules (if applicable).

- Quotes: Get 2–3 detailed quotes. Ensure they break down hardware, labor, and permit costs separately.

- Verification: Verify current incentive schemes via government energy sites or national agencies to ensure the grant money hasn't run out.

Challenges and Policy Outlook

What Are the Risks?

The solar market is subject to policy volatility. Subsidy cuts can happen overnight, and future EU funding post-2027 remains uncertain. Grid curtailment (where the grid refuses your solar export) is becoming an issue in saturated markets.

Where Are the Opportunities?

Battery prices are falling, making self-consumption more affordable. New building mandates across the EU are standardizing installations. Community solar is growing, offering options for those without suitable roofs.

How Can You Stay Informed?

Monitor national energy agency alerts. Consult certified local installers who are often the first to know about changes in local grant availability.

Conclusion

Solar panel subsidies and local regulations dictate your economic outcome more than geography or sunshine hours. While the upfront cost can be daunting, the combination of grants, VAT reductions, and long-term energy savings makes solar a prudent financial decision for most Europeans.

Whether you are retrofitting a family home with a subsidized grid-tied system or opting for a portable generator to bypass permitting entirely, the goal remains the same: reducing reliance on the grid. Prioritize self-consumption, evaluate your property's eligibility for incentives carefully, and choose the hardware that fits your legal and financial reality.

Appendices

Glossary

- FiT (Feed-in Tariff): A guaranteed payment for electricity exported to the grid.

- Net-metering: A billing mechanism that credits solar energy system owners for the electricity they add to the grid.

- kWp (Kilowatt peak): The maximum power output of a PV system under standard test conditions.

- Self-consumption: Using the solar energy you generate directly in your home rather than exporting it.

- Curtailment: The reduction of output from a renewable resource to balance energy supply and demand.

Worksheet: Estimating Payback

- System Cost: (Hardware + Installation) - (Grants + Tax Credits) = Net Cost.

- Annual Savings: (kWh Generated × Self-Consumption Rate × Electricity Price) + (kWh Exported × Export Tariff).

- Payback Period: Net Cost ÷ Annual Savings = Years to Break Even.

Sources

Frequently Asked Questions

How do policy changes impact existing solar installations?

Most policy changes apply to new systems, but retroactive changes can affect long-term ROI. Check if your contract includes "grandfathering" clauses that protect your original rates.

Can I combine different subsidy types in one project?

This depends on the country; you often must choose between an upfront grant and ongoing feed-in tariffs. However, VAT reductions usually apply regardless of other incentives.

What if my roof isn't suitable for solar panels?

Consider joining a community solar project or a shared rooftop program. Alternatively, portable power stations provide energy resilience without requiring a permanent roof installation.

How does solar panel recycling work in Europe?

Under the EU's WEEE Directive, producers are responsible for the end-of-life management of solar panels. This ensures panels are recycled properly, recovering valuable materials like silver and silicon.